ad valorem tax florida ballot

Florida property taxes vary by county. The ad valorem tax exemption program awards performance-based incentives to companies paying above the county average wage of 40640 or 1954 per hour.

2022 State Tax Reform State Tax Relief Rebate Checks

You may also be part of a special district or assessment boundary that has different taxes than a nearby area.

. The tax roll describes each non-ad valorem assessment included on the property tax notice. From raising the minimum hourly wage to tax discounts for spouses of certain deceased veterans on Nov. TAXATION--MUNICIPALITIES--Effect of general law requiring advertisement of and public hearings on budgets of taxing authorities on special law requiring.

Whereas Amendment 1. Referendum and ad valorem tax. Copies of the non-ad valorem tax roll and summary report are due December 15.

101173 District millage elections. Raising Floridas Minimum Wage What it says. Six proposed constitutional amendments will be on the ballot Nov.

The ballot question asks St. At least 60 of voters must approve an amendment for it to pass so it is vitally important that voters understand. The 2021 Florida Statutes.

Ad valorem means based on value. Ad Fill Sign Email FL DR-504 More Fillable Forms Register and Subscribe Now. The property appraisers responsibility is to determine market value of your property and to maintain equity within the tax roll.

Non-ad valorem assessments are often used as service charges. This is the last of six on this years ballot and its full name is. The 2021 Florida Statutes.

2 2 Florida S Latest Fair Elections Imbroglio Concerns Party Names On The Ballot The Fulcrum 2020 Florida Constitutional Amendments Ballot. Property Tax Oversight Program. The Duval County Public Schools Florida Ad Valorem Tax Measure is on the ballot as a referral in Duval County Public Schools on August 23 2022.

Home ad tax valorem wallpaper. 1 MILLAGE AUTHORIZED NOT TO EXCEED 2 YEARS. Provides an extension of Ad Valorem Tax Discount for Spouses of Certain Deceased Veterans who had permanent combat-related disabilities.

Lucie County voters if the Economic Development Ad Valorem Tax Abatement incentive should be authorized for another 10 years. The greater the value the higher the assessment. A no vote opposes continuing.

Palm Bay Florida 32905. Article VII Finance and Taxation. 1 AD VALOREM TAXES.

Ad Valorem Tax Discount for Spouses of Certain Deceased Veterans. Raises minimum wage to 1000 per hour effective September 30th 2021Each September 30th thereafter minimum wage shall increase by. YES Proposed by citizen initiative and entitled Citizenship Required to Vote in Florida Elections which provides that only United States citizens who are at least 18 years of age.

Provides that the homestead property tax discount for certain veterans with permanent combat-related disabilities carries over to such veterans surviving spouse who holds legal or beneficial title to and who permanently resides on the homestead property until he or she remarries or sells or otherwise disposes of the property. An elected board may levy and assess ad valorem taxes on all taxable property in the district to construct operate and maintain district facilities and services to pay the principal of and interest on general obligation bonds of the. A yes vote supports continuing the levying of an ad valorem tax at a rate of 1 per 1000 of assessed property value for four years 2023-2027 to pay school teachers and fund school programs.

Some counties use only or nearly only valorem taxes. Common examples include water and sewer waste collection and fire or ambulance. A yes vote supports levying an ad valorem tax of 1 mill 1 for every 1000 of assessed value to pay schoolteachers and fund public and charter school programs.

In December 1999 the question of whether the city commission should be granted the authority to grant exemptions from city ad valorem taxes pursuant to Article VII section 3 Florida Constitution and section 1961995 Florida Statutes for new businesses and expansions of existing businesses was placed on the ballot1. The Orange County Public Schools Florida Ad Valorem Tax Measure is on the ballot as a referral in Orange County Public Schools on August 23 2022. In Florida property taxes and real estate taxes are also known as ad valorem taxes.

Lucie County Board of County Commissioners authorized the placement of the Economic Development Ad Valorem Tax Abatement on the primary ballot on Aug. 1 The Board of County Commissioners or. An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendment.

The district school board pursuant to resolution adopted at a regular meeting shall direct the county commissioners to call an election at which the electors within the school districts may approve an ad valorem tax millage as authorized in s. 3 the stakes are high for Floridians. City of Palm Bay.

An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendmentIf enacted this measure would have mandated that no county or municipality shall levy ad valorem taxes on more than 30 percent of the value of any homestead property for certain seniors 40 percent of the value of all. Ad valorem tax florida ballot Sunday March 13 2022 Edit. The incentive was first authorized by.

One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. 2145 Palm Bay Road NE. Tax collectors are required by law to annually submit information to the Department of Revenue on non-ad valorem assessments collected on the property tax bill Notice of Taxes.

Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect. 21812 Appropriations to offset reductions in ad valorem tax revenue in. Impact fees and user charges.

Florida Department of Revenue. Section 1961995 Florida Statutes requires that a referendum be held if. Heres what you need to know.

If enacted this measure would have mandated that no county or municipality shall levy ad valorem taxes on more than 30 percent of the value of any homestead property for certain seniors 40 percent of the value of all other. Ad Valorem property tax exemptions can be granted to new and expanding businesses only after the voters of a city andor county vote in a referendum to allow that city or county to grant exemptions. 101173 District millage elections.

How Do You Know If You Qualify For The Missouri Property Tax Credit Government And Politics Dailyjournalonline Com

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center

Remote Work Tax Reform Improving Tax Mobility And Tax Modernization

Duval School Board Votes 6 1 To Put Property Tax Onto August Ballot Wjct News

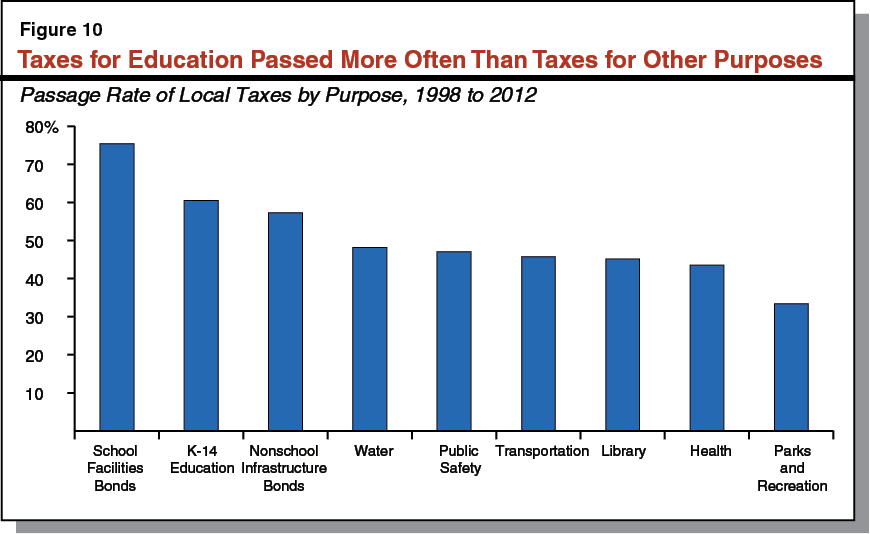

A Look At Voter Approval Requirements For Local Taxes

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Amendments 5 And 6 On Florida S Ballot Focus On Florida Property Taxes The Independent Florida Alligator

Jacksonville Civic Council Supports School Tax Increase Jax Daily Record Jacksonville Daily Record Jacksonville Florida

Florida S State And Local Taxes Rank 48th For Fairness

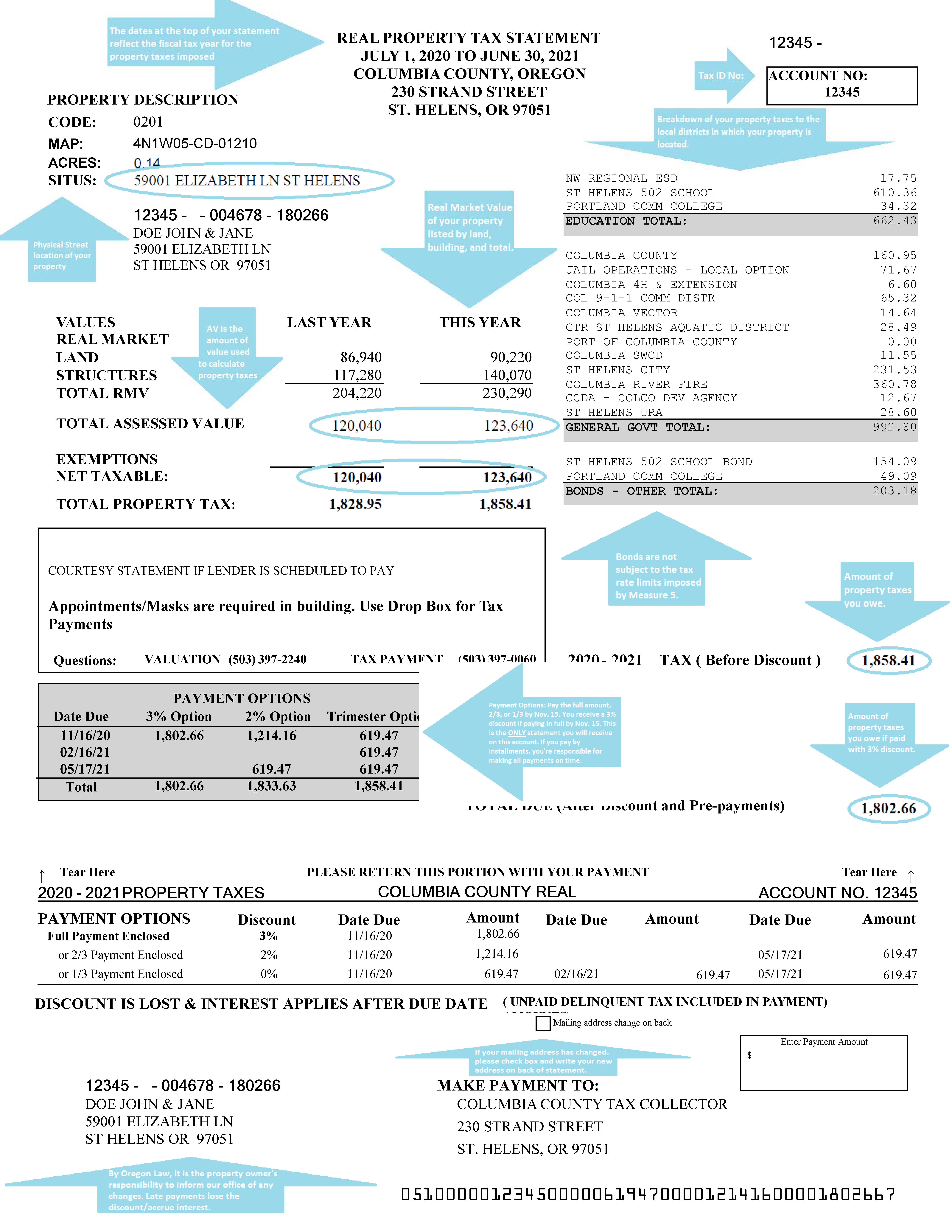

Columbia County Oregon Official Website Understanding Your Property Tax Statement

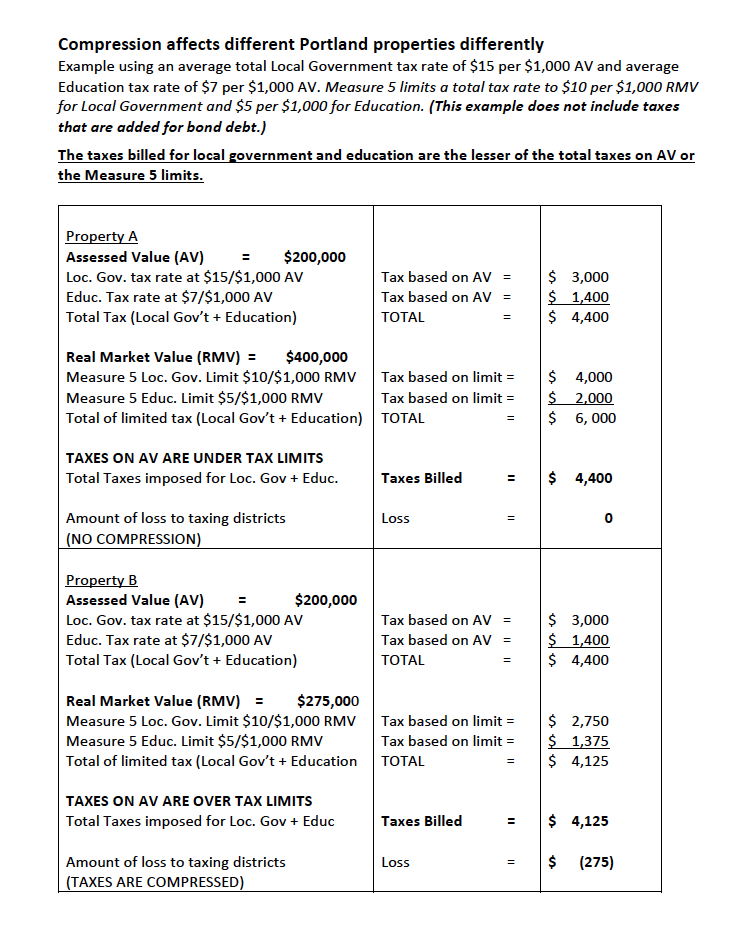

Property Taxes Compression Ballot Measures League Of Women Voters Of Portland

Understanding Your Vote Fort Myers Florida Weekly

Florida To Vote In November On Additional Property Tax Exemption For Certain Public Service Workers Ballotpedia News

Lawsuit Challenges Pension Tax Referendum Ballot Language Wjct News

Explaining Florida Amendment 6 Tax Discount For Spouses Of Certain Deceased Veterans

Louisiana Amendment 5 Payments In Lieu Of Property Taxes Option Ktalnews Com